The Economic Impact of AI on G20 Nations: Strategic Imperatives for Leaders

Executive Summary

Artificial Intelligence is poised to become the most significant driver of economic transformation for G20 nations in the coming decades. By 2030, global GDP could be approximately 14% higher due to AI adoption—equivalent to an additional $13–16 trillion. This unprecedented growth opportunity demands strategic action from business leaders, policymakers, and investors to ensure both competitiveness and inclusive prosperity.

Organizations that implement comprehensive AI strategies are consistently outperforming competitors by significant margins. Similarly, nations with robust AI ecosystems are positioned to capture disproportionate economic benefits. This article examines the multifaceted economic impacts of AI on G20 nations and provides actionable insights for decision-makers navigating this transformative landscape.

GDP and Productivity Gains

AI's contribution to economic growth across G20 nations will be substantial and accelerating. We at HMS Goldman find that our economic projections align with PwC estimates of a $15.7 trillion boost to global GDP by 2030, with productivity improvements accounting for approximately $6.6 trillion and increased consumer demand for AI-enhanced products generating $9.1 trillion.

By 2040, AI could generate $15–22 trillion in economic value annually, with the AI software and services market alone potentially reaching $15–23 trillion per year—roughly equivalent to the current GDP of the United States. By 2050, even conservative projections suggest AI will add 10–15% to global GDP.

AI-driven productivity enhancements are at the heart of these GDP gains:

Manufacturing: Implementation of AI for predictive maintenance, quality control via computer vision, and robotics on assembly lines has shown efficiency improvements of up to 30% in advanced factories.

Financial Services: AI implementation in algorithmic trading, fraud detection, and customer service automation has demonstrated 20% productivity improvements in the banking sector.

Healthcare: AI-assisted diagnostics, treatment planning, and drug discovery show potential savings of 5–10% in healthcare spending while improving outcomes.

Retail and E-commerce: Supply chain optimization through AI demand forecasting and logistics management has achieved inventory reduction of up to 25% for leading retailers.

Comparative analysis among G20 nations reveals an uneven landscape of AI adoption and investment:

Current projections indicate China and North America are positioned to capture nearly 70% of the global AI dividend by 2030. China's national AI strategy and massive investments could yield a 26% boost to its GDP by 2030—about $7 trillion in value—the largest of any country. The United States could see around a 14–15% GDP boost (~$3.7 trillion) from AI by 2030.

Labor Market Transformation

AI will be a net job creator on a global scale through 2030, though with significant disruption. According to World Economic Forum data, 170 million new jobs could be generated worldwide by 2030 in emerging fields, while 92 million jobs are displaced by automation—a net gain of approximately 78 million jobs.

This disruption will transform approximately 22% of all jobs in some way by 2030. New roles will center on technology, data, and AI itself, with demand for AI specialists forecast to grow by approximately 40% by 2027.

Sectors will be affected differently:

On average across the OECD (which includes many G20 countries), about 27% of jobs are in occupations at high risk of automation from AI and related technologies.

Up to two-thirds of current jobs could be partially exposed to AI automation, with about 25% of jobs seeing 50% or more of their tasks automated in the coming decade.

The fastest-growing occupations include AI and machine learning specialists, data analysts, and digital transformation specialists.

Roles expected to decline include routine office positions, factory workers in routine assembly, and certain service roles like bank tellers or telemarketers.

Differential wage effects across skill levels are already emerging. Workers with high-tech skills or AI expertise are commanding premium wages as demand outstrips supply. In contrast, wages for lower-skilled, routine jobs face downward pressure as these positions become increasingly automatable. Research suggests that 39% of core skills for workers will change by 2030 in response to AI and other drivers, highlighting the urgent need for continuous upskilling.

Country-specific labor market dynamics vary significantly:

Japan faces a rapidly shrinking and aging workforce and is embracing AI and robotics aggressively to fill labor gaps. Japan is working to counteract a projected shortfall of 11 million workers by 2040.

India has a youthful, growing workforce and a large IT services sector, focusing on using AI to enhance service delivery and create new digital services jobs while mitigating potential disruption to back-office and call center positions.

United States is experiencing robust job creation in tech and AI research roles, but also displacement in manufacturing regions, creating a shift from routine middle-skill jobs into either high-skill tech jobs or lower-skill service roles.

European G20 economies (Germany, France, UK) are focusing on AI augmentation strategies. Germany's Industrie 4.0 encourages combining AI with workers on factory floors through collaborative robots.

China is investing massively in AI and automation to climb the value chain and counter demographic slowdown.

Trade and Geopolitical Implications

AI is reshaping global trade patterns and geopolitical relationships in profound ways. Several critical trends have emerged:

AI can make global trade more efficient by optimizing shipping routes, managing supply chain logistics in real time, and reducing production costs. Conversely, AI might reduce the need for some traditional trade by enabling more local production and reshoring.

G20 nations that emerge as AI leaders will gain new competitive advantages in the international arena. AI leadership confers first-mover advantages in setting industry standards, dominating key platforms, and attracting global talent and investment.

AI-related trade policies and regulations are increasingly being developed across G20 nations:

The United States has implemented export controls on advanced AI chips and software to certain countries on national security grounds.

China is ramping up indigenous chip production and offering AI solutions to other countries.

The EU's AI Act will impact trade by requiring compliance from imported AI systems.

Techno-economic blocs centered on technology are forming:

The United States and its allies (EU, Japan, South Korea, Australia) are collaborating on AI research, ethical guidelines, and supply chain security.

China is spearheading its own AI ecosystem, investing heavily through its Belt and Road Initiative's Digital Silk Road.

Nations may increasingly align with whichever power provides them AI capabilities, whether through aid, investment, or affordable products.

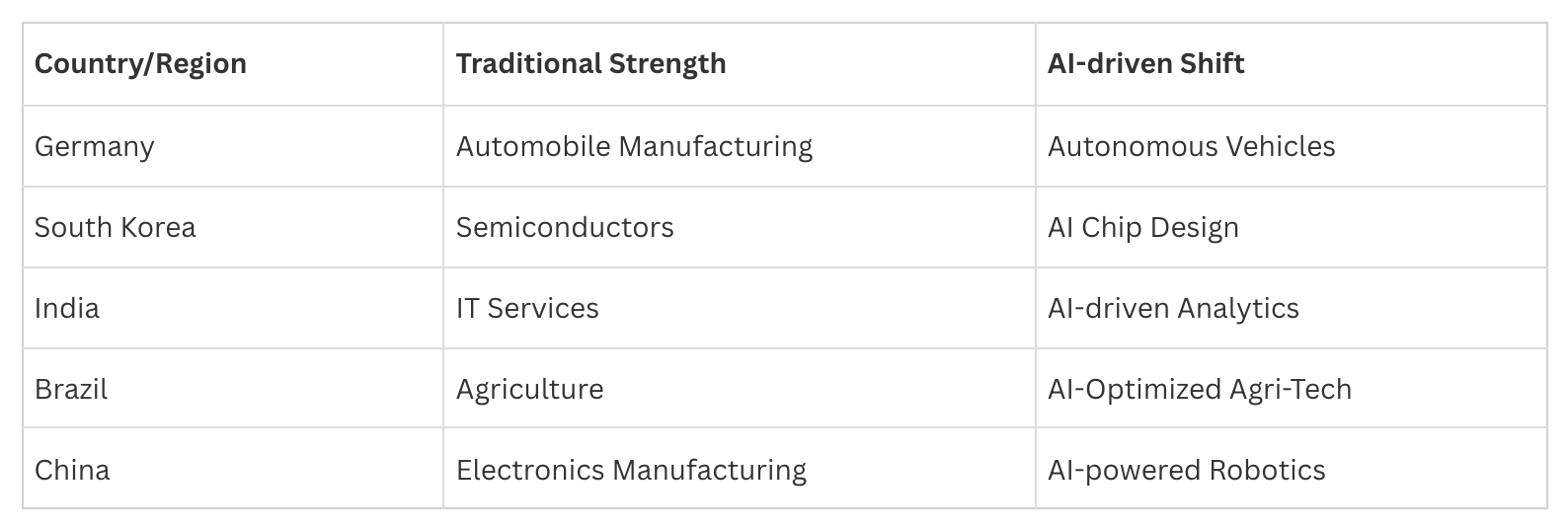

Shift in Comparative Advantage

AI is realigning traditional comparative advantages of nations. It diminishes the importance of cheap labor and amplifies the value of technology and skills, thereby altering which countries have competitive advantages in certain industries.

Global supply chains are adapting to AI-driven efficiencies. Greater automation enables reshoring or near-shoring of manufacturing. Companies are evaluating whether production should move closer to consumer markets rather than being spread based on labor arbitrage.

Knowledge-intensive economies (technology, finance, advanced manufacturing, education, entertainment) are positioned to benefit more from AI than resource-intensive economies. Countries whose economies are based on knowledge industries can leverage AI to further boost these fields.

Resource-rich G20 members such as Saudi Arabia or Russia are investing oil revenues into AI and tech to diversify their economies, recognizing that future comparative advantage may lie in tech know-how rather than natural endowments.

Country-wise shifts in industrial dominance are emerging:

China is rapidly gaining ground in industries like drones, electric vehicles, and telecommunications equipment by embedding cutting-edge AI.

Germany is infusing AI into automotive engineering to maintain its edge in car exports.

Japan is leading in robotics to remain dominant in high-end machinery exports.

United States maintains dominance in digital industries and AI could further cement that position.

South Korea dominates semiconductor fabrication, a critical piece of AI hardware.

At HMS Goldman, we've observed that emerging G20 economies such as Brazil, Mexico, and Indonesia have opportunities to leapfrog into new industries while mitigating threats to existing sectors.

AI and Services Trade

AI is transforming international trade in services. Traditionally, many services were considered non-tradable or difficult to deliver across borders. AI and digital platforms are changing that by enabling services to be digitized, automated, and provided remotely with high quality.

Finance, healthcare, and professional services are among the sectors witnessing AI-driven evolution:

In finance, AI algorithms facilitate cross-border capital flows through automated trading, risk assessment, and fraud detection.

Healthcare services are seeing new trade models through telemedicine platforms powered by AI diagnostic tools.

Professional services like legal processing, accounting, and design are increasingly delivered digitally with AI automating portions of the work.

Cross-border trade in AI-enabled solutions is growing rapidly, with increasing international demand for:

Software-as-a-service offerings that incorporate AI

Cloud AI platforms

AI algorithms themselves as exportable goods

AI is also redefining outsourcing and offshoring trends. Automation is supplanting some traditional offshoring, with AI chatbots and voice assistants handling customer inquiries that used to be answered by offshore call center agents. However, rather than a straightforward decline in offshoring, it's leading to a shift toward higher-value tasks.

Techno-Economic Blocs

The formation of techno-economic blocs—clusters of countries aligning their economic and technological policies around AI—has significant implications for businesses and investors:

Western democracies bloc: Led by the U.S. and EU, focusing on developing and governing AI in line with shared values. Japan, Canada, South Korea, Australia, and the UK are strategically aligned with this bloc on preserving an open, rule-bound AI ecosystem.

China-centered network: China's strategy has been to invest heavily domestically while exporting its technology to build influence. Countries in Southeast Asia, Africa, the Middle East, and Latin America that have adopted Chinese tech may lean towards China's AI ecosystem.

Many countries realize they cannot excel in every aspect of AI, leading to technological dependencies. The EU has strong research but lags in AI platform companies and semiconductor manufacturing. Japan and Korea are allied with the U.S. but also selling chips to China—a delicate balance.

The economic implications of these dependencies are significant. Countries in a bloc will trade more within it for AI and digital goods. This can lead to duplication of efforts (two parallel AI supply chains) which has efficiency costs globally.

Global South and Inequality

Without deliberate action, there is a real risk of AI widening economic disparities both between countries and within countries.

Within the G20, members like South Africa, India, Indonesia, Brazil, Argentina, and Mexico represent the developing or emerging economies. Compared to G7 members, these countries generally have fewer AI research centers, less private investment in AI, and less digital infrastructure. While advanced economies may boost GDP by double digits with AI by 2030, some developing G20 economies might only see low single-digit gains without intervention.

This gap means the economic divide could widen. Wealthier G20 nations stand to capture most of the $15–20 trillion AI dividend, while poorer nations capture a smaller slice. Furthermore, AI could erode the competitive edge of developing economies reliant on cheap labor.

Several potential policy responses could mitigate inequality:

Massive investment in STEM education and digital literacy in developing G20 countries

Infrastructure investment: expanding internet access, subsidizing cloud computing access for startups or universities

Adaptation of the development model: encouraging sectors that AI cannot easily disrupt

"AI solidarity"—where advanced countries share AI technology and best practices with developing ones

Strengthening social safety nets to deal with potential job displacement

New Trade Domains

Several entirely new trade domains are being enabled by AI technologies:

Digital goods created by or delivered via AI: These include AI-generated content, trained AI models, and large datasets, raising complex questions around classifying these goods for customs and protecting intellectual property rights.

AI-as-a-Service (AIaaS): Cloud-based AI platforms offering services like machine learning model training, AI analytics, or pre-trained AI capabilities via API. The growing cross-border usage of these services represents a significant trade flow in the digital economy.

Autonomous logistics and transportation: AI-enabled autonomous ships, drones, trucks, and warehouses will transform logistics networks across borders.

New data-intensive services: Precision agriculture advisories, smart city management services, and AI-driven energy management can now be sold internationally.

With these new trade domains, policy frameworks must evolve in key areas including data governance, standards and interoperability, intellectual property and licensing, regulatory sandboxes, labor and skill mobility, taxation, and competition policy.

Strategic Recommendations

For CEOs and Business Leaders:

Develop a clear AI strategy aligned with business goals: Identify how AI can drive value through improving operations, enhancing products, or enabling new business models. Companies that scale AI across the enterprise are significantly more likely to outperform peers.

Invest in workforce skills and change management: Upskill employees on digital and data literacy and reskill those in roles likely to be automated. Ensure clear communication about how AI will be used and involve employees in the transition.

Leverage AI for decision-making and innovation: Use AI not just in operations, but in strategic decision support. Task R&D teams to incorporate AI capabilities into products to stay ahead of competition.

Ensure ethical and responsible AI use: Establish guidelines for ethical AI—avoiding biases, respecting privacy, and being transparent about AI usage. Implement AI governance boards, bias audits, and compliance with emerging regulations.

Collaborate and share best practices: Participate in industry consortia and cross-industry think tanks on AI. Share non-sensitive data or collaborate on pre-competitive AI research.

For Governments and Policymakers:

Craft national AI strategies and invest in digital infrastructure: Develop clear strategies for AI development aligned with your country's strengths and needs. Invest in high-speed internet, 5G networks, and computing resources.

Implement education and workforce policies for the AI age: Update education and training systems to embed STEM and AI-related curriculum at all levels. Provide incentives for lifelong learning and strengthen career counseling and job matching services.

Balance innovation and regulation: Implement light-touch regulation and sandboxes for new AI applications while establishing necessary guardrails in sensitive areas. Ensure outcome-focused regulation that addresses impacts without dictating technology choices.

Update trade policies for the digital era: Push for international agreements on e-commerce and data flows that allow businesses to exchange data across borders securely. Avoid excessive protectionism on digital goods/services.

Social policies to ensure inclusive growth: Consider progressive taxation and redistribution of the gains from AI. Strengthen labor institutions to help workers have a say in how AI is implemented and negotiate for a fair share of productivity gains.

International cooperation and knowledge sharing: Use forums like the G20, OECD, and World Bank to share best practices and help each other. Consider collaborative AI projects tackling global challenges.

Conclusion

The AI revolution presents an unprecedented opportunity for economic growth and innovation across G20 nations. However, it also brings significant challenges in terms of workforce disruption, geopolitical tensions, and potential inequality.

Those who act strategically now—investing in technology, infrastructure, and human capital—will be positioned to thrive in the AI-powered economy of tomorrow. At HMS Goldman, we remain committed to supporting forward-thinking organizations and governments in developing strategies that drive sustainable, inclusive growth in this new era.

This analysis is based on research from leading economic and industry institutions, complemented by our observations from working with organizations across G20 nations.